.png)

How Artificial Intelligence improves investment decision making

January 11, 2024

Table of contents

Quick Access

Artificial intelligence is here to stay. This technology, which is an imitation of human reasoning and thinking to carry out routine tasks and processes, had a resurgence in 2023 and was positioned as the most used in people's daily lives, both in their daily activities and in business, including affecting decision-making when investing.

Before entering into the topic, it is valid to technically know what the term artificial intelligence refers to. On our website, we explain “AI (Artificial Intelligence) refers to the ability of machines to imitate human intelligence. AI technology involves creating algorithms and computer programs that can perform tasks that typically require human intelligence, such as visual perception, speech recognition, decision making, and language translation.”

From generating images and text to performing virtual assistant tasks, artificial intelligence has many uses for people and companies, but there is one that has recently gained popularity and is worth exploring: its help when making decisions. investment and spending decisions.

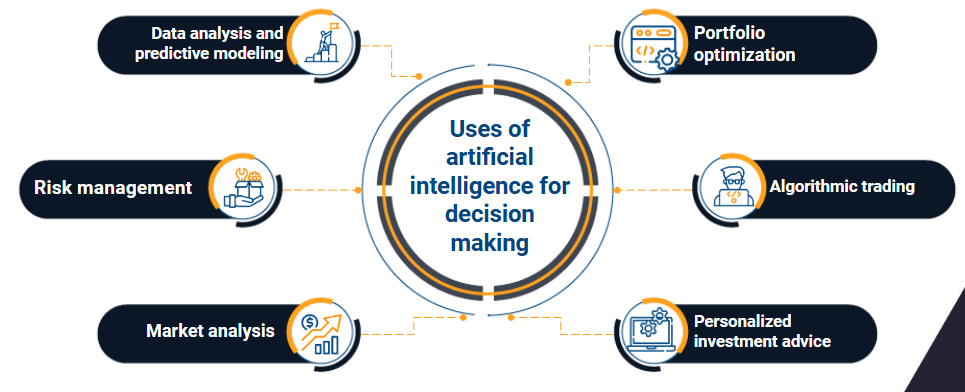

Uses of artificial intelligence in the decision-making process for an investment

Investing personal or company money is not a task that should be taken lightly; there are several important aspects that must be taken into account before deciding the amount of money to spend or its destination.

Artificial intelligence tools, such as ChatGPT for example, can be useful during the early stages of the investment, offering help or guidance to the user or client. AI can help in:

Data analysis and predictive modeling

One of the key strengths of AI lies in its ability to process and analyze enormous sets of data at speeds beyond human capabilities. Machine learning algorithms can identify patterns and trends in financial data, offering valuable insights into market behavior. By leveraging historical data, AI models can create predictive models, helping investors make more informed decisions about potential market movements.

Risk management

AI plays a crucial role in improving risk management strategies for investors. Advanced algorithms can evaluate and quantify various types of risks associated with investment portfolios. By continuously monitoring market conditions and analyzing historical risk factors, AI can provide real-time risk assessments, allowing investors to quickly adjust their portfolios and mitigate potential losses.

Market analysis

Understanding market sentiment is vital to successful investing. AI-powered sentiment analysis tools crawl news articles, social media, and other online sources to measure overall sentiment toward specific stocks or markets. By interpreting the collective mood of investors, AI can provide valuable information on potential changes in the market, helping investors anticipate changes and make timely decisions.

Portfolio optimization

AI-powered portfolio optimization tools have revolutionized the way investors manage their assets. These tools consider various factors, such as risk tolerance, investment objectives, and market conditions, to create and adjust portfolios that maximize returns and minimize risk. AI algorithms can adapt to changing market dynamics, ensuring portfolios remain optimized for current conditions.

Algorithmic trading

The impact of AI on investment decision-making is perhaps most evident in the realm of algorithmic trading. High frequency trading algorithms can execute trades at speeds and frequencies unattainable by human traders. These algorithms analyze market data, identify opportunities and execute trades in a matter of microseconds, taking advantage of even the smallest inefficiencies in the market.

Personalized investment advice

AI-powered robo-advisors provide investors with personalized investment advice based on their financial goals, risk tolerance, and market conditions. These platforms use sophisticated algorithms to recommend and manage investment portfolios, making financial advice more accessible and cost-effective for a broader range of investors.

Fraud detection and compliance

AI improves investment decision-making by helping to detect and prevent fraudulent activities. Machine learning algorithms can analyze transaction data and identify patterns associated with fraudulent behavior. Additionally, AI can help financial institutions ensure compliance with regulatory requirements, reducing the risk of legal issues.

At Rootstack, we have a team of artificial intelligence experts available to jump into any project our clients need. Don't hesitate to contact us so we can start helping you.

We recommend you on video

Related Blogs

E-commerce Website Development

The services that Odoo Colombia offers to its partners

AI Development Services in a Technology Company

Oracle in Software Development: Advantages for Leading Companies

Oracle en el Desarrollo de Software: Ventajas para Empresas Líderes