How AI detects fraud and improves payment management in the public sector

Table of contents

Quick Access

Digital transformation in governments has ceased to be an aspiration and has become an urgent necessity. Artificial intelligence in the federal government is emerging as a key tool to improve efficiency, reduce losses, and detect fraud.

One of the areas with the greatest potential for impact is government financial management, where AI for governments offers concrete solutions for fraud prevention and payment optimization.

A persistent problem: Improper payments in the federal government

The Government Accountability Office (GAO) of the United States reported that during fiscal year 2024, the federal government made approximately $162 billion in improper payments. Since 2003, this cumulative figure has reached $2.8 trillion. These errors range from overpayments to inaccurate records to deliberate fraud.

This outlook highlights the urgent need to incorporate artificial intelligence into the federal government to optimize financial systems, improve internal controls, and reduce significant losses of public resources.

AI and Automation: Allies in the fight against fraud

Several entities are already integrating AI into the public sector to combat fraud more effectively. According to The Global Treasurer, 73% of financial organizations already use AI for fraud detection, and another 23% plan to implement it soon. The reason is clear: AI models improve fraud detection accuracy by more than 50% compared to traditional systems.

Unlike fixed-rule approaches, AI algorithms for governments adapt and learn from new fraud tactics in real time, allowing them to respond to emerging threats much more effectively.

This ability to constantly evolve is essential against fraudsters who also use AI tools to circumvent traditional security systems.

Private sector success stories that inspire the public sector

One of the most revealing cases is that of JP Morgan, which has used large AI-based language models for more than two years to validate payments and reduce fraud.

The results are overwhelming: a 15% to 20% reduction in account validation rejection rates and an improved user experience. Additionally, AI allows them to present customers with critical information such as cash flow analysis in a timely manner.

This model can be replicated in government automation, with solutions that validate social payments, tax refunds, or subsidies, detecting errors or anomalies in real time and preventing fraud before it occurs.

The US treasury example: AI saving billions

The US Treasury Department began using machine learning in 2022 to analyze large volumes of data and prevent check fraud. According to NVIDIA, these AI tools in the public sector helped prevent or recover more than $4 billion in fraud during fiscal year 2024.

These results make it clear that implementing artificial intelligence in the federal government is not only feasible, but also generates multi-million-dollar savings, reduces human error, and strengthens transparency.

Strategic partnerships to expand the impact of AI on the public sector

Collaboration between public and private entities is also playing a key role. Microsoft, for example, partnered with Moody's to develop risk and analytics tools based on generative AI.

These partnerships can be replicated in the government sector to strengthen real-time fraud detection, with customized solutions tailored to each agency.

This type of partnership allows for rapid scaling of AI use in the public sector with cutting-edge technology, without the need to develop systems from scratch, speeding up the adoption of new financial security practices.

AI solutions governments can use to detect fraud

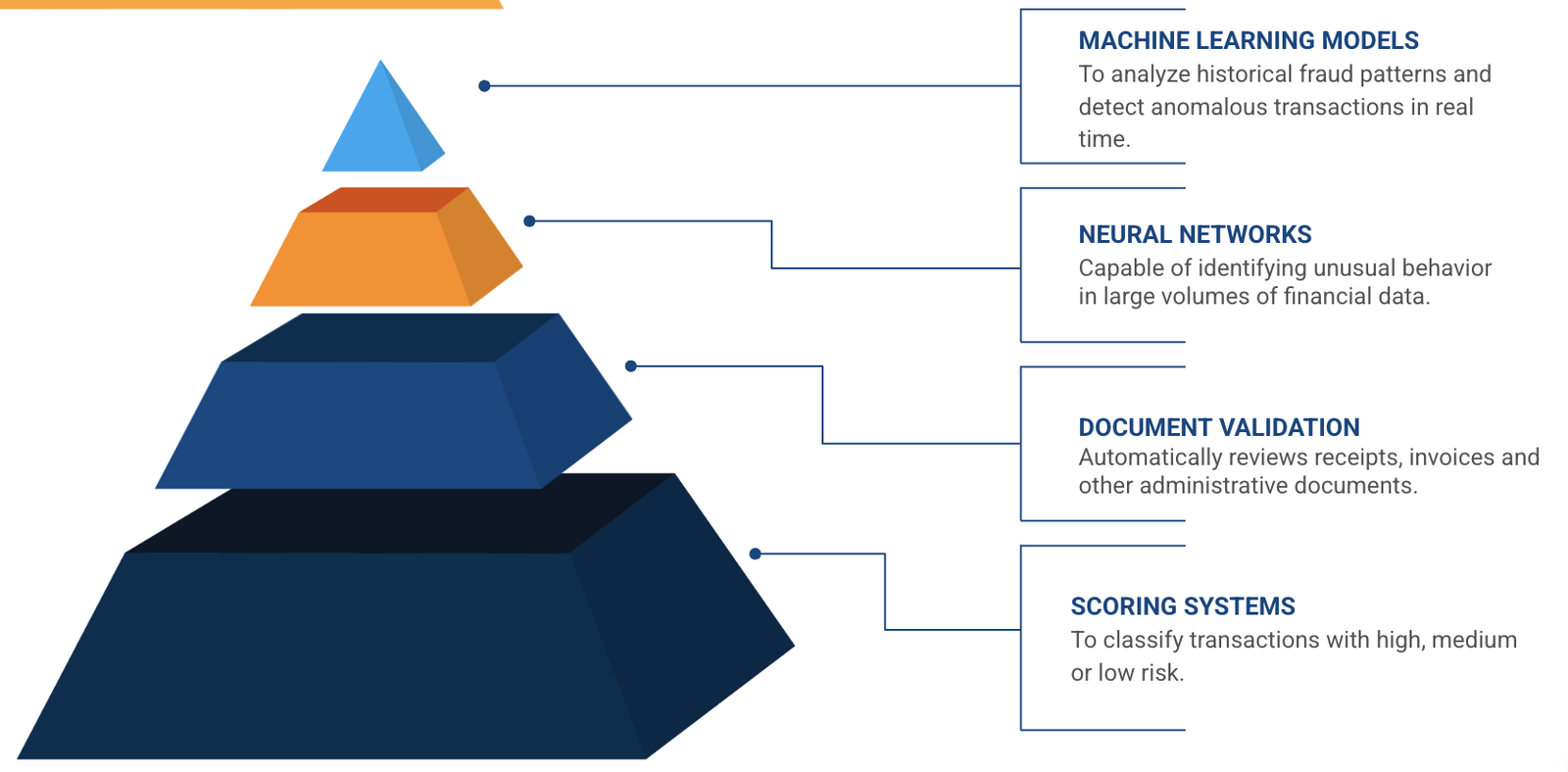

Government automation implementations for financial management can include multiple AI-powered tools. Some of the most effective are:

Machine learning models: to analyze historical fraud patterns and detect anomalous transactions in real time.

Neural networks: capable of identifying unusual behavior in large volumes of financial data.

Generative AI for document validation: that automatically reviews receipts, invoices, and other administrative documents.

Automated scoring systems: to classify transactions as high, medium, or low risk.

Natural language processing (NLP): to review payment requests and assess their authenticity.

All of these tools can be integrated in a modular and scalable manner at different levels of the federal government, from local agencies to national entities, improving the effectiveness of fraud detection.

Rootstack: A trusted provider of AI solutions for governments

On this path toward modernizing the public sector, Rootstack stands out as a strategic ally.

With extensive experience implementing AI solutions for governments, Rootstack has worked with public institutions on government automation projects, developing predictive systems, and data analytics platforms that integrate artificial intelligence into the federal government.

Its approach is based on delivering measurable, secure results tailored to the specific needs of each entity.

The adoption of AI in the public sector is no longer an option, but a necessity to optimize resources, reduce losses, and ensure the integrity of public finances.

And with partners like Rootstack, this path can be taken with confidence and tangible results. Contact us.

Related blogs

Banking software development company | Rootstack

Firewall solutions for IoT: Protect your business network

IoT Authentication: Key Methods for Protecting Devices

IoT penetration testing: Why it's crucial and necessary

Main IoT security risks and how to mitigate them