In the current context of Panama's financial sector, delinquency represents a persistent challenge, especially in rural areas where limited access to digital services and geographical dispersion hinder traditional collection processes. Banks and financial entities face significant losses by not having effective tools to monitor and manage overdue portfolios in these sectors. Given this scenario, the implementation of a portfolio and collections management software becomes a strategic solution to optimize operations, improve cash flow, and reduce the delinquency rate.

The Challenge of Collections in Rural Areas

Panama, although possessing a robust financial system, still faces a significant gap between urban and rural areas in terms of access to financial technologies. According to a World Bank study, only 51% of the adult population in rural areas has access to formal financial services. This limitation translates into operational difficulties for banking entities, which must follow up on clients with low levels of banking, scarce internet access, and often, without digitalized credit history.

Consequently, traditional collection strategies—such as in-person visits or phone calls—become costly, slow, and ineffective. This is where modern collection software comes into play, providing automated and centralized tools to address these challenges.

What is a Portfolio and Collections Management Software?

A credit and collections management software is a technological solution designed to monitor, organize, and execute collection actions efficiently. This type of system allows financial institutions to:

- Automate collection notifications (SMS messages, emails, automated calls).

- Prioritize accounts based on risk or delinquency level.

- Geolocate clients to optimize visit routes.

- Generate real-time reports on the overdue portfolio.

- Integrate with existing banking systems or CRMs.

Implementing this type of tool not only reduces the manual effort of the collection team but also improves the debt recovery rate by acting proactively and segmentally.

What are the Most Effective Collection Systems in Rural Areas?

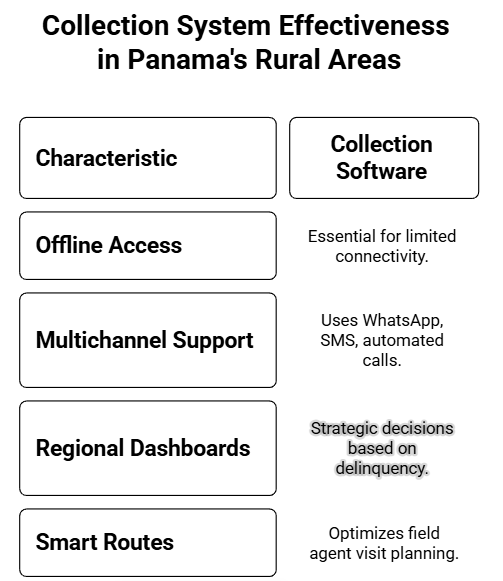

In the specific case of Panama and its rural regions, the ideal collection system must adapt to the local context. Some key aspects that good collection software for these areas should cover include:

- Offline access or weak signal support: It is vital that the system functions with limited connectivity and can synchronize data when there is a signal.

- Multichannel support: Utilize accessible communication channels such as WhatsApp, SMS, or automated calls to reach clients wherever they are.

- Regional visualization dashboards: So that management teams can make strategic decisions about areas with high delinquency rates.

- Smart in-person collection routes: Thanks to geolocation, field agents' visits can be optimally planned.

Competitive Advantages for Banks in Panama

For financial entities in Panama, having robust portfolio and collections management software can make the difference between a healthy portfolio and an unproductive one. Some of the main advantages of adopting this type of solution include:

Greater traceability: It allows tracking contact history with each client, registering payment agreements, and monitoring compliance.

Reduced delinquency: Automation allows for quick action before a debt becomes uncollectible.

Data-driven decision making: Thanks to detailed reports, resources can be focused on the most critical areas or segments.

Reduced operational costs: Eliminates the need for repetitive manual actions and optimizes the use of field personnel.

Improved customer experience: By offering more accessible payment options and non-invasive contact, the customer relationship is strengthened, even in delinquency.

Success Stories and Technological Adoption in the Region

Several banks and credit unions in Latin America are already actively investing in collections management solutions. For example, a financial entity in Guatemala implemented digital collection tools to improve its presence in rural areas, managing to increase its recovery rate by 25% in less than a year.

These types of results are possible thanks to the strategic use of technologies such as artificial intelligence, machine learning, and automation, which allow adapting the collection process to the specific behavior of each client.

Rootstack: Your Technological Ally for Implementing an Efficient Collection System

At Rootstack, we understand the particular challenges faced by financial entities in Panama, especially in rural areas where monitoring overdue portfolios becomes a titanic task. Our team of software development experts has worked with multiple institutions to design customized credit and collections management systems, adapted to the local context and the specific needs of the client.

We offer integrated solutions that include:

- Custom software development, integrable with your banking systems.

- Intuitive interfaces for collection and management teams.

- Automation of communications with delinquent clients.

- Continuous technical support and evolutionary updates.

Our approach is 100% consultative: we analyze your operation, identify critical points, and build scalable software that helps you achieve your recovery goals, even in hard-to-reach areas.

Delinquency in rural areas should not be a condemnation for banks in Panama. With the right support and the correct technology, it is possible to transform a manual, costly, and limited operation into an agile, automated, and effective process. Good portfolio and collections management software not only improves your institution's financial indicators but also positions you as a modern, efficient, and service-oriented entity. Are you ready to transform your collection process and recover what is rightfully yours? At Rootstack, we are ready to help you take that step.

We recommend in video