Predictive modeling in banking: from predictive marketing to claims analysis

Table of contents

Quick Access

Artificial intelligence is here to stay, which means industries have only one choice: adapt. Banking companies may be among the most benefited right now, as they can implement a powerful tool into their systems: predictive model tools.

Financial institutions face growing pressure to adopt technological tools that help them anticipate customer needs, detect risks before they happen, and make data-driven decisions rather than relying on assumptions. This is where predictive models play a crucial role.

A predictive model, simply put, is a solution based on artificial intelligence and machine learning algorithms that can forecast future outcomes using historical data and behavioral patterns. This tool, which has already transformed industries like retail and healthcare, now represents a vital competitive advantage for the banking sector.

“Examples of predictive models include estimating the quality of a sales opportunity, the likelihood of spam, or the probability that someone will click a link or purchase a product,” explains Tech Target.

From Customer Acquisition to Claims Analysis

The versatility of predictive models in banking is so broad that it can be applied from the early stages of the commercial funnel, such as predictive marketing, to internal processes like customer claims analysis and management. In other words, a bank can use this technology to both attract the right customer and retain them, optimize their experience, and minimize operational risk.

Predictive Marketing: Intelligence Driving Customer Acquisition

Predictive marketing uses advanced analytics techniques to anticipate customer needs and behaviors. By analyzing data such as purchase history, digital platform activity, previous interactions with the bank, and demographic variables, predictive models can identify which financial products are most relevant to each profile.

For example, if a young, digitally active customer has shown interest in small investments or cryptocurrencies, a well-trained model can automatically recommend a low-risk, high-liquidity investment product. This way, the bank delivers exactly what the customer needs at the right time, increasing conversion rates and improving the user experience.

Credit Behavior Prediction and Risk Reduction

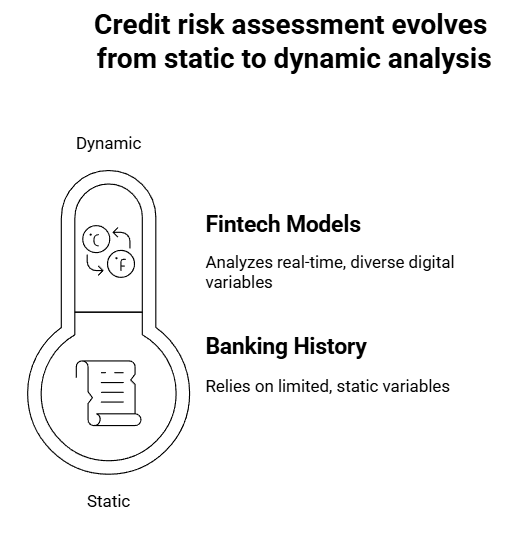

Another key use of fintech predictive models is credit risk assessment. Unlike traditional systems that rely on static variables such as banking history or monthly income, modern models can analyze hundreds of variables in real time—from social media behavior to digital service usage and geolocation.

This allows the creation of much more accurate and personalized risk profiles, resulting in better decision-making for credit approvals, reduced default rates, and greater financial inclusion.

Fraud and Money Laundering Prevention

Predictive models can also identify anomalous patterns that may indicate financial fraud or money laundering. By comparing a customer’s current behavior in real time with their historical patterns, the system can generate automatic alerts for suspicious movements, avoiding reputational damage and regulatory sanctions.

This type of solution not only strengthens the bank's internal security but also streamlines compliance processes.

The International Compliance Association, in one of its articles, discussed the use of generative AI in this case: “Vendors claim generative AI can significantly improve the detection of suspicious activities. By analyzing large amounts of data and recognizing complex patterns, systems can identify risks and illicit activities that may go unnoticed by human analysts or traditional software systems. Some vendors even automate report submission to national intelligence agencies.”

Claims Management: Moving Toward Proactive Banking

One of the most innovative applications of predictive models in modern banking is their use in analyzing and managing customer claims. Instead of acting reactively, banks can anticipate which types of customers are likely to file complaints, through which channels, how frequently, and for what reasons.

This allows customer service areas to adopt a proactive stance: reinforce specific channels, improve processes before problems escalate, and generate early alerts. Additionally, the system can automatically classify the most critical claims, prioritize them, and assign them to the appropriate team based on the nature of the issue.

As a result, customer satisfaction increases, response times decrease, and the institution's perception of efficiency and empathy improves.

Why Implement Predictive Models with Rootstack?

At Rootstack, we understand the unique challenges of the banking sector and know that one-size-fits-all solutions don’t work. Our approach is to develop custom predictive models, built from scratch based on each bank’s data, processes, and objectives.

We have proven experience in building models to:

- Optimize predictive marketing campaigns through advanced segmentation.

- Automate risk decisions in credit approvals.

- Detect fraud in real time using behavioral patterns.

- Anticipate claims and improve customer experience.

Unlike "plug and play" platforms, our solutions integrate seamlessly with the bank’s existing systems—such as CRMs, core banking platforms, or analytics tools—ensuring a smooth and secure implementation. We also operate under strict data governance standards and comply with all local and international regulations, including Data Protection Laws and regulations such as GDPR and AML/KYC.

At Rootstack, we guide you from conceptualization to the implementation of tailor-made predictive models. Contact us today and transform how your bank makes decisions.

Recommended Video

Related blogs

AI applied to the optimization of operational processes in banking

MCP: Key to orchestrating AI agents in complex business processes

How AI is transforming business automation

How to plan your AI automation project with MCP

Banking software development company | Rootstack