AI and machine learning: what they can do for fintech companies

April 10, 2023

Table of contents

Quick Access

Technology is taking over all business spaces, this is evident when we analyze the tasks we do daily: work is done on computers, we have an application on our cell phones for everything we do every day, and banking operations come in here. The financial industry is the one that has benefited the most or changed its processes with the rise of technology and it is right here where the term "Fintech" comes into play.

What is Fintech?

What do we mean by Fintech? To define this, we will resort to what Investopedia explained “Financial technology (better known as fintech) is used to describe a new technology that seeks to improve and automate the delivery and use of financial services. At its core, fintech is used to help businesses, business owners, and consumers better manage their financial operations, processes, and lives. It is made up of specialized software and algorithms used on computers and smartphones. Fintech, the word, is an abbreviated combination of "financial technology."

This explanation may be a bit difficult to understand, so let's go to a practical example of what Fintech are: when you transfer money to a checking account through a cell phone, send money through Venmo or a similar application, manage your cryptocurrency account or invest through an online broker, with all these cases you are using Fintech.

What are the types of Fintech

Fintech encompasses a wide range of technologies and services that are used to improve and optimize financial activities. These are some types of fintech:

- Digital Banking: Online and mobile banking services that allow customers to manage their finances, transfer money, and pay bills.

- Payment Processing: Services that enable the processing and acceptance of payments, such as credit cards, mobile payments, and digital wallets.

- Investment Management: Online platforms that provide investment advice, portfolio management and automated investment services.

- Peer-to-Peer Lending: Online lending platforms that connect borrowers with individual investors, bypassing traditional financial institutions.

- Cryptocurrency and blockchain: digital currencies and decentralized ledger technologies that offer secure and transparent transactions.

- Insurance Technology: Insurance companies using technology to streamline the insurance buying process, claims management, and fraud detection.

- Regtech: Technology solutions designed to help financial institutions meet regulatory requirements and reduce regulatory risks.

- Personal Finance Management: Apps and services that help people manage their money, track their spending, and improve their financial habits.

- Wealth Management: Online tools and platforms that provide financial planning, investment management, and other financial services to high net worth individuals and institutions.

- Crowdfunding: Platforms that connect investors with startups and entrepreneurs seeking financing.

Fintech and its business growth

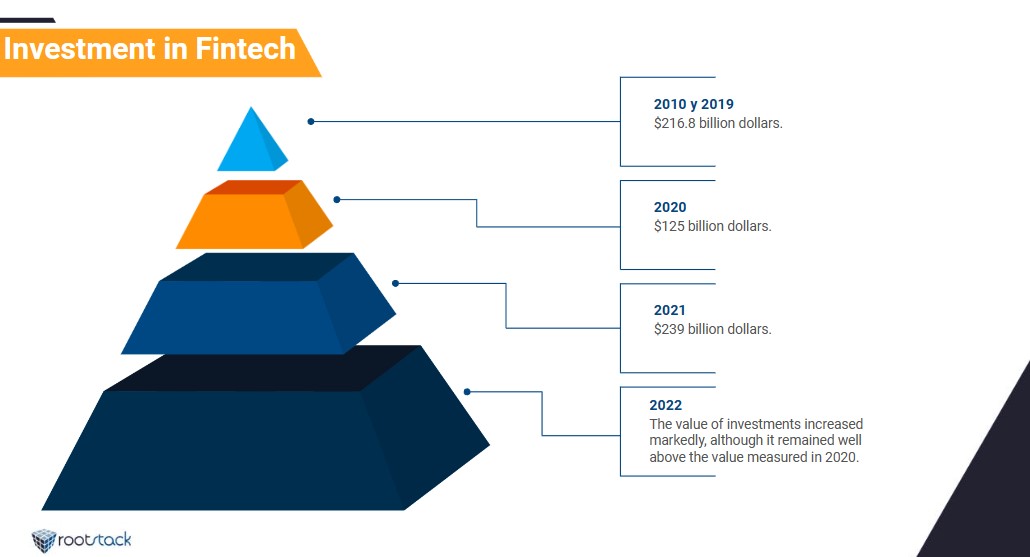

Investment in Fintech industries has grown over the years, this is an example of the confidence that banking institutions have in technology and tools that help simplify operations and increase customer confidence in their banks, as well to give you facilities to manage your money.

Statista carried out a study on investment in fintech industries from 2010 to 2022, finding as a result “The total value of investments in fintech companies worldwide increased dramatically between 2010 and 2019, when it reached 216.8 billion dollars. In 2020, however, fintech companies saw their investments decline by more than a third, falling below US$125 billion. The investment value increased again in 2021 to almost US$239 billion. 2022, however, was another slow year for fintechs, as the value of investments increased markedly, although it remained well above the value measured in 2020.

The same portal specialized in statistics and data, also did research on the number of Fintech startups in the world, publishing that there are 10,755 in the United States alone, a figure that is reduced when looking at those in Europe, the Middle East and Africa. , where they total a total of 9,323. The Asian region is still behind everyone, there are 6,268 Fintech startups.

Artificial intelligence and machine learning: the new “boom” of technology

Surely in recent months you have tried to change your image with the popular filters of social networks: creating a photo with a different background or slightly modifying your face or body, all this is done thanks to artificial intelligence which is dominating the world of technology and represented the present and future in terms of technological tools.

At TechTarget they offer a definition of Artificial Intelligence “Artificial intelligence is the simulation of human intelligence processes by machines, especially computer systems. Specific AI applications include expert systems, natural language processing, speech recognition, and computer vision.

While talking about artificial intelligence, machine learning should be mentioned as one of its most popular tools for business use. "Machine learning is a branch of artificial intelligence (AI) and computing that focuses on the use of data and algorithms to imitate the way humans learn, gradually improving their accuracy" they explain on the IBM portal.

Benefits of artificial intelligence and machine learning for Fintech

Artificial intelligence (AI) and machine learning (ML) have numerous benefits for fintech companies. Here are some of the key benefits:

Fraud detection

AI and ML algorithms can analyze vast amounts of data in real time to detect fraudulent activity such as credit card fraud, identity theft, and money laundering. These algorithms can quickly flag suspicious transactions and help prevent financial loss.

Customer service

AI-powered chatbots can provide 24/7 customer support and answer basic queries such as account balance, transaction history, and payment processing. This can reduce the workload of human customer service representatives and improve customer satisfaction.

Personalized financial services

AI and ML can help fintech companies analyze customer data to provide personalized financial advice, investment recommendations, and credit scoring. This can improve customer engagement and increase customer loyalty.

Risk assessment

AI and ML algorithms can assess credit risk, identify potential defaults, and predict loan repayment behavior. This can help fintech companies make informed decisions and reduce the risk of financial loss.

Efficient operations

AI and ML can automate manual processes like data entry, document processing, and compliance checks. This can reduce operating costs, increase efficiency, and improve accuracy.

Overall, AI and ML have the potential to transform the fintech industry by improving customer experiences, reducing costs, and increasing revenue opportunities.

We recommend you on video

Related Blogs

.jpg)

Key aspects of hiring a Shopify Plus designer

How to unadd yourself from Shopify

How to publish a product variant on Shopify

5 Reasons to Choose Odoo