.png)

How to manage user data and privacy in a banking project

December 22, 2023

Table of contents

Quick Access

There is nothing more important within a software project than data security protection, especially when working with a bank or financial company. Protecting sensitive information not only ensures regulatory compliance, but also builds trust among customers.

When working with a development agency or a technology consulting company, a correct guide must be established for the steps to follow to manage and strengthen the security of user data in a banking project.

That is why our experts have prepared a complete guide on how to manage user data and privacy effectively in a banking project.

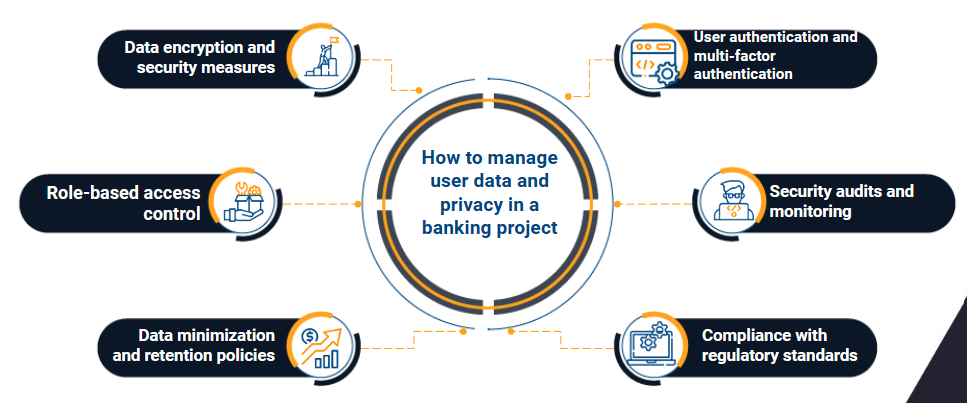

Step by step on how to manage the privacy and security of user data within a banking project

1. Data encryption and security measures

Implementing strong data encryption is the first line of defense against unauthorized access. Use industry-standard encryption protocols to protect data both in transit and at rest. Additionally, ensure the use of Secure Sockets Layer (SSL) certificates to encrypt data during online transactions.

2. Role Based Access Control (RBAC)

A good practice when managing user data in a banking project is to implement a role-based access control system to restrict access to sensitive data. Assign specific roles to users based on their responsibilities, ensuring that employees only have access to the information necessary for their tasks. Periodically review and update access permissions to reflect changes in personnel and responsibilities.

3. Data minimization and retention policies

Follow the principle of data minimization, collecting only the information necessary for essential banking services. Implement clear data retention policies to determine how long customer data is stored and establish procedures to securely delete outdated information. This not only reduces the risk of data breaches, but also ensures compliance with data protection regulations.

4. User authentication and multi-factor authentication (MFA)

Implement strong user authentication mechanisms, such as username and password combinations, and improve security by incorporating multi-factor authentication (MFA). MFA adds an extra layer of protection by requiring users to verify their identity through additional means, such as a code sent to their mobile device.

5. Regular security audits and monitoring

Conduct regular security audits to identify and address vulnerabilities. Use advanced monitoring tools to track user activity and detect any suspicious behavior. Real-time alerts can help prevent unauthorized access or data breaches, allowing immediate action to be taken.

6. Compliance with Regulatory Standards

Stay informed and comply with relevant privacy and data protection regulations, such as GDPR, HIPAA or local banking regulations. Regularly update systems and procedures to align with changing compliance requirements and educate staff on the importance of meeting these standards.

7. Transparent privacy policies

Maintain transparency with customers by clearly communicating your privacy policies. Provide easily accessible and understandable information on how user data is collected, processed and protected. Obtaining explicit consent for data processing activities helps build trust with customers.

Data must be managed effectively

In conclusion, effective management of user data and privacy is a critical component of any banking project. By taking a multi-faceted approach that includes robust security measures, access controls, and regulatory compliance, financial institutions can create a safe and secure environment for their customers.

Prioritizing the protection of user data not only safeguards confidential information, but also strengthens the long-term relationship between the bank and its customers.

At Rootstack, with more than 10 years of experience, we have a team with the necessary knowledge and skills to apply security tools in all your financial projects, just contact one of our business advisors and start experiencing digital transformation.

We recommend you on video

Related Blogs

Steps for software product development

-9.20.37-a.m.png)

Product Design and Development

Tools for Machine Learning

The Best Data Science Tools in 2025

What is Data Science?