Today we live in a globalized world, where physical barriers are no longer a limitation when making a purchase. This is why it’s so important to have international payment gateways on your website that allow transactions from anywhere in the world and in multiple currencies.

A payment gateway, simply put, is a software solution capable of processing payments from different sources, some of them in international currency, giving customers an easier checkout experience.

These solutions are designed for easy integration with multiple payment methods and come with innovative tools to comply with security and data protection regulations in the financial and commercial sectors.

Why take the step and integrate international payment gateways?

Let’s start by analyzing why it’s crucial to have a payment gateway that operates globally:

- Significant reduction in cart abandonment: According to a recent study, 13% of customers abandon a purchase if their preferred payment method isn’t available.

- More sales with fewer complications: 94% of cross-border shoppers expect to pay in their local currency and with methods commonly used in their country.

- Boosting growth worldwide: Using solutions tailored to each region increases conversion and loyalty, which is essential for international growth.

It’s clear: to smoothly enter foreign markets, you need international gateways that provide local alternatives, fair pricing, and a seamless user experience.

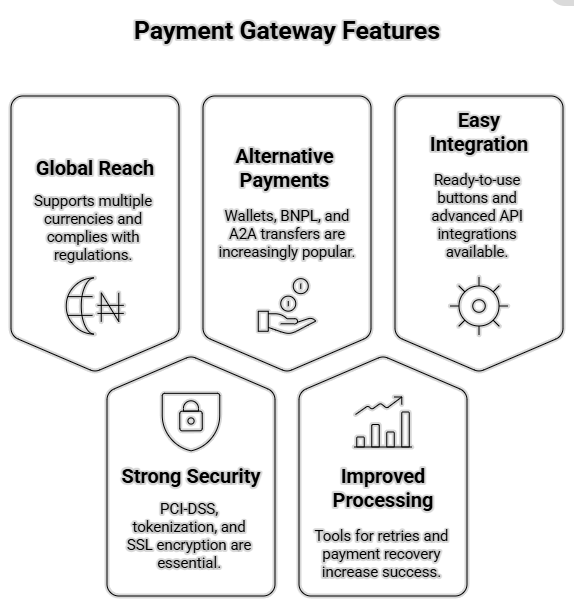

What makes a payment gateway stand out?

Not all gateways are the same. To gain a competitive advantage, keep the following in mind:

- Global and local reach. A good provider supports transactions in multiple currencies and complies with regulations in each market, ensuring effective conversions.

- Strong security and compliance. PCI-DSS, tokenization, and SSL encryption are essential. Tools like Visa Click to Pay reduce fraud by up to 91% and speed up authorization by 10%.

- Acceptance of alternative payment methods. Beyond cards, options like wallets, BNPL (Buy Now, Pay Later), or A2A transfers are expected to account for 69% of online purchases by 2029.

- Improved payment processing. Tools for retries and payment recovery increase successful transactions and help recover failed ones.

- Efficiency and easy integration. From ready-to-use buttons to advanced API integrations, the right choice depends on your business size and tech team.

The current landscape and its strategic importance

The rise of local payments in LATAM

In Latin America, initiatives like PIX in Brazil have radically changed payment habits. PIX is expected to surpass credit cards in e-commerce by 2025, reaching 44% of the total. In Colombia, PSE has already overtaken cards as the most used online payment method, and digital revenues are projected to triple, reaching USD 300 billion by 2027.

Innovative ecosystems and global interconnection

PayPal plans to launch PayPal World in fall 2025, a platform connecting leading wallets from various regions—such as Mercado Pago, UPI, and Weixin Pay—making cross-border payments easier for two billion people.

Unifying initiatives in Europe

In Europe, EPI introduced Wero, a digital wallet covering the entire continent with features for online payments, subscriptions, BNPL, and more, rolling out in Germany, France, Belgium, and the Netherlands between 2024 and 2025.

With Rootstack, your platform won’t just accept payments: it will inspire trust, adapt to each market, and position you as a global leader.

We recommend this video