What are the advantages of using an ESB software solution in the banking industry?

July 07, 2023

Table of contents

Quick Access

Having multiple programs for computer use might be a pain if the right link between all of them cannot be formed. An ESB, or Enterprise Service Bus, solution is used to overcome this problem.

This solution is defined by our specialists as follows: "At its most basic, Enterprise Service Bus (ESB) is an architecture that allows different applications to be integrated by putting a communication bus between them and then allowing each application to talk to the bus."

"ESB advances by providing the scalability that every company requires to continue growing successfully." It arose from the necessity to avoid the challenges of point-to-point integration while boosting organizational agility and decreasing the time to market of new proposals."

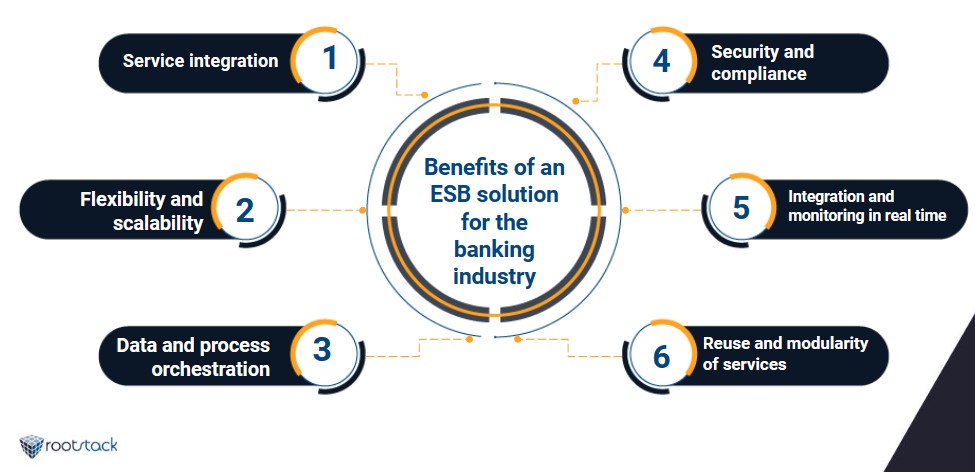

Benefits of an ESB software solution for the banking industry

Implementing an Enterprise Service Bus (ESB) software solution can offer several benefits to the banking industry. Here are some key advantages:

Integration of Services

ESB enables the integration of multiple banking systems and applications, such as core banking systems, customer relationship management (CRM) software, payment gateways, and fraud detection systems. It allows for smooth communication and data sharing between different systems, resulting in improved operational efficiency and customer service.

Scalability and adaptability

ESB architecture is adaptable to changing business needs and can allow future development. Banks frequently have a complex IT environment with various systems, and an ESB enables them to integrate and extend their infrastructure without the need for extensive bespoke code. This scalability enables banks to more readily launch new services, channels, or technologies.

Integration of Services

ESB enables the integration of multiple banking systems and applications, such as core banking systems, customer relationship management (CRM) software, payment gateways, and fraud detection systems. It allows for smooth communication and data sharing between different systems, resulting in improved operational efficiency and customer service.

Scalability and adaptability

ESB architecture is adaptable to changing business needs and can allow future development. Banks frequently have a complex IT environment with various systems, and an ESB enables them to integrate and extend their infrastructure without the need for extensive bespoke code. This scalability enables banks to more readily launch new services, channels, or technologies.

Monitoring and integration in real time

Because ESB allows for real-time integration, banks can respond to client requests and market movements more swiftly. It enables the instant interchange of data and events between systems, allowing for real-time analysis and decision making. Monitoring and alerting capabilities are also provided by ESB, allowing IT teams to proactively discover and handle issues, maintaining high system availability and performance.

Modularity and reuse of services

This solution emphasizes the Service Oriented Architecture (SOA) principle, which fosters the creation of reusable services. Banks can enhance agility and reduce development time for new apps or features by using modular services. ESB facilitates service discovery, composition, and reuse, supporting improved collaboration across development teams and a speedier time-to-market for new solutions.

System integration for legacy systems

Many banks continue to rely on old systems that may be difficult to combine with new technologies. ESB can serve as a bridge, enabling for the seamless integration of legacy systems with modern applications or services. It enables banks to leverage their existing legacy system investments while updating their infrastructure.

In summary, an ESB software solution can provide banks with better integration capabilities, flexibility, scalability, security, compliance, real-time processing, service reuse, and legacy system interaction. In the fast-paced banking industry, these advantages can assist increase operational efficiency, client experience, innovation, and competitive advantage.

We recommend you on video

Related Blogs

Free Magento Commerce Features for an Online Store

How to use chatbots for e-commerce?

Which API is best for Android App Development Services

How to automate processes with Odoo software

What programming language is used with React Native?