A few months ago, one of our banking clients in Central America faced an urgent problem: their delinquency rate had increased by 28% in less than a year. Their collections team operated manually, with no visibility into client status, no preventive alerts, and zero automation. The core banking system they used was robust for daily operational management, but lacked tools for collections monitoring or debt recovery strategies.

Does this sound familiar?

Many banks in Latin America and the United States face the same scenario. Their core banking systems, though functional, do not natively integrate smart collections solutions. This forces them to operate with fragmented processes, Excel spreadsheets, manual calls, and a high margin of error.

Why does your core banking system need a debt management software?

In an economic environment marked by uncertainty and rising delinquency, controlling overdue portfolios is not optional; it's a priority. The traditional core banking system fulfills its central function—managing accounts, loans, transactions—but rarely focuses on active collections management.

According to a study by Deloitte, 60% of financial institutions lack integrated digital tools for collections and debt recovery, negatively impacting both revenue and customer experience.

Common limitations of a core banking system without collections management:

- Lack of visibility into delinquent clients.

- Inability to define personalized collections flows.

- No preventive collections alerts or tracking.

- Reactive, manual processes without artificial intelligence.

- Poor traceability throughout the recovery cycle.

The solution is to integrate a specialized collections system that complements your core banking system, allowing you to implement preventive, automated, and customer-oriented strategies.

What is debt collections management software?

Debt collections management software is a technological platform that allows tracking, control, and automation of the credit recovery process. This solution enables segmenting clients by risk level, automating payment reminders, assigning collections flows, generating real-time reports, and making data-driven decisions.

At Rootstack, we have implemented systems that integrate artificial intelligence to establish “smart collections models.” These models analyze a client’s payment history, behavior profile, and risk level to determine when, how, and through which channel to carry out the most effective action.

Core banking integration: the most important step

A common mistake among financial institutions is implementing collections solutions as external modules without properly integrating them into their core banking system. This creates information silos and hinders decision-making.

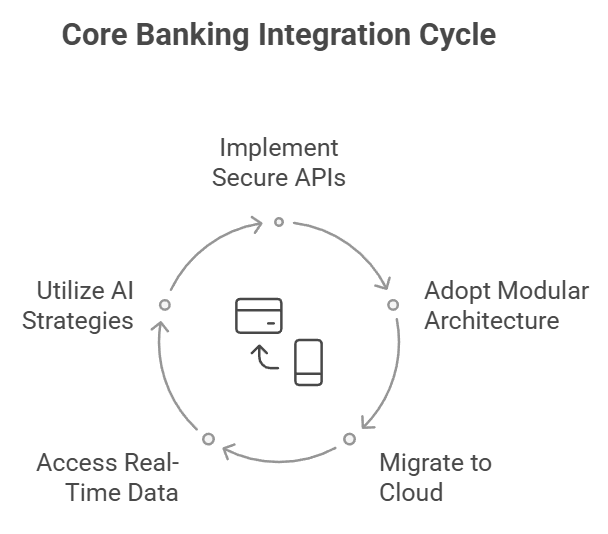

At Rootstack, we specialize in integrating debt management software directly into the core banking system, ensuring the entire operation is unified and synchronized. This integration can be achieved through:

- Secure, customized APIs that connect the collections system to real-time data in the core banking system.

- Modular architecture that maintains technological independence while centralizing operations.

- Progressive migrations from legacy environments to modern cloud-based solutions.

This way, your collections teams can access real-time client information, payment history, due-date alerts, and AI-recommended strategies—all within the main banking ecosystem.

Benefits of integrating a smart collections system

By integrating debt collections management software with your core banking system, you gain:

- Significant reduction in delinquency: thanks to early alerts, personalized flows, and automated follow-up.

- Optimization of human resources: allowing your collections team to focus on intelligent contact strategies rather than repetitive tasks.

- Improved customer experience: collections become preventive, empathetic, and personalized.

- Greater traceability and control: with detailed reports by channel, region, agent, and client segment.

- Regulatory compliance: alignment with standards like PCI‑DSS and GDPR through secure data handling.

What is preventive collections and why implement it?

Preventive collections is among the most effective strategies you can implement with modern software. It involves identifying early warning signals of possible default and acting before debt becomes delinquent.

With this approach, your institution can:

- Generate automatic alerts before payment due dates.

- Send personalized notifications via digital channels (SMS, email, apps).

- Offer restructuring options before default occurs.

- Enhance client perception of your bank.

All this is possible if your core banking system is ready to integrate flexible, modern collections management solutions.

Rootstack: proven expertise in core banking and collections

At Rootstack, we have worked for over 15 years with banks and financial institutions in the United States and Latin America, developing tailored technology solutions. We understand the limitations of traditional core banking systems and the urgency of adapting to the new digital environment.

We provide:

- Strategic consulting for core banking modernization.

- Integration of collections modules and portfolio tracking.

- Development of financial software with a focus on scalability and security.

- Implementation of AI-powered collections.

Our differentiator is clear: we combine deep financial industry knowledge with a highly skilled technical team, delivering secure, robust, and customized solutions.

Conclusion: transform your collections process and boost profitability

The sustainable growth of your bank depends, among many things, on the health of your portfolio. That health is strengthened with technology that allows you to anticipate risks, automate processes, and make informed decisions.

A modern core banking system must go beyond accounting and product management. It must be the center of intelligent operations, capable of integrating collections modules that reduce delinquency, increase recovery, and enhance client relationships.

At Rootstack, we are ready to support you in this journey. Whether you're looking to migrate your core banking system, modernize your tech architecture, or implement advanced collections tools, we have the experience and technology to make it happen.

Recommended Video